Bitcoin’s future has become a topical issue of deliberation recently. From its ever-high price of about $ 69,000, the first-generation coin has fallen more than 70 percent. Trying to regain its lost footing, it has even traded for less than $ 18,000 as of June 2022. Through the mayhem, there have been mixed reactions from all corners of the world. So what should investors expect from bitcoin?

The Vision of Bitcoin

Satoshi Nakamoto’s idea of a decentralized currency is what bore Bitcoin that has joined many other technologies causing disruption. Although it looked unrealistic goal more than a decade ago, it won many investors. Behind the scenes of what we see, there is a complicated technology of decoding information. Its purpose is to frustrate the efforts of fraudsters. Even with that technology, Bitcoin is yet to achieve its objective with a myriad of challenges surrounding it. It has been marked by wild price swings, missteps, and scandals.

Events Centering Bitcoin’s Vision

Issues relating to what could be termed as security were rampant in the recent past. In the United States, for instance, two individuals were arrested in February 2022 for the allegation of conspiracy to launder cryptocurrency valued at $4.5 billion in 2016. During the arrest, Deputy Attorney General Lisa O. Monaco mentioned that it was the most significant financial seizure ever and that cryptocurrency is not a haven for criminals.

In addition to the scandals, the process of getting this asset has recently hit headlines creating some questions and suspicion on environmental ramifications. An estimate by the University of Cambridge points out that annual energy generation by Bitcoin alone is 132.48 terawatt-hours (TWh). With such energy, the emission of carbon dioxide is relatively high. Although the last mining happened in 2020, proof of work takes place, and it takes a lot of energy thus affecting the environment because of huge carbon dioxide released.

Consequences of the events

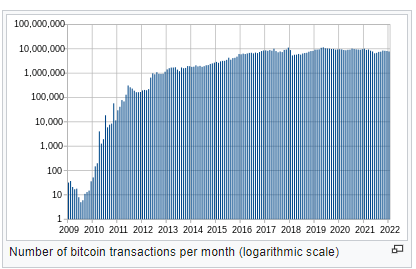

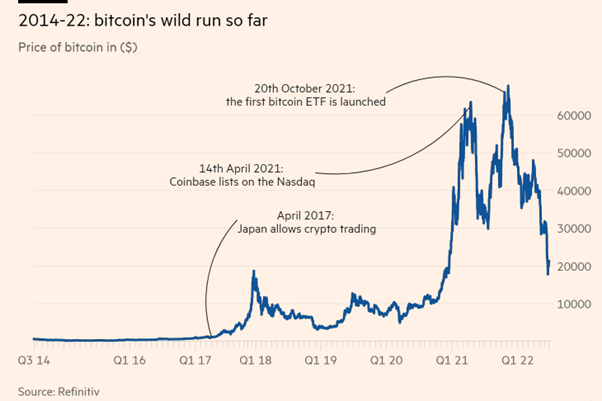

As a result of the above matters relating to Bitcoin, the asset started trading in the red. It’s been quite long at this unfavorable level of price. Looking back at the price dynamics of Bitcoin is very amazing. As of 2011, its price was merely about $1, and it positively changed, rising to $69,000 in late 2021 before it went down again to about $ 17,000 (as of 18th June 2022).

Along the way, there were ups and downs in how prices moved, and it seemed to have no stable position. The ever-reducing prices have sent some fear to trading platforms like Binance halting and blocking the withdrawal of Bitcoins. Although CEO said in a tweet that the temporary pause was a result of a transaction that got stuck, promising for short period fix, it sent fear to investors and those ambitious equally.

Is Bitcoin management contradicted?

A Look at how these prices changed, raises the question, who controls the price given that there is no centralization? Since economic policies do not apply to Bitcoin compared to fiat currencies, demand and supply, and the cost of mining becomes the only force behind these changes. In the year 2020, which the last mining happened, other factors led to a decrease in demand. Such aspects as covid-19 created economic crisis across the globe, general inflation, and Russia’s invasion of Ukraine are among the key issues that deepened the already struggling market price of Bitcoin.

Although creating these assets aimed at decentralization, recently, a concern emerged that whales (those who own a lot of bitcoins) are the ones controlling the prices. If that is true, then what benefits do they get from low prices? Of course, any investor aims to reap the most in any investment. If there is no benefit currently, are they planning for something that some players in the industry do not know? Or they have already executed their thing and what is seen is the smoke?

Some of these unclear situations make small investors not know what to expect from bitcoin as they trade.

What Follows?

Small investors who rushed into the bitcoin market were the power behind the boom in the market clinging to the hope of profiting within a short time. A writer of the Financial Times Long view column, Katie Martin commented that bitcoin is the most speculative on the planet of all time.

With the turn of events and amid extreme fear zone trading, there is a possibility that there will be recovery, but it won’t be immediate. With regulators promising to be “unrelentingly hard”, it becomes cloudy on how any future rules will work practically. However, there is abundant evidence of joined-up thinking, and if regulators succeed in setting rules, the crypto industry will gain more trust and eventually deliver some stability.

Although this view of recovery maybe possible, temptation to take China’s perspective can’t miss. Here, a newspaper-run purview of the Chinese Communist Party published an article warning against Bitcoin investments. There is a belief that the price is likely to head to zero. Therefore, investors should stay warned against parking money in Bitcoin. Further, allegations are that bitcoin is nothing more than a string of codes. As a result, its returns are based on buying low and selling high. Accordingly, once the confidence of investors loosens or sovereign countries illegalize Bitcoin, it will go back to its original value which is almost worthless.

Conclusion

The two views place one in a dilemma situation not knowing what exactly should investors expect from bitcoin. Not even a single professional can predict with clarity this future. It is mere guesswork based on some historic information and data. Most importantly, understand that comments by celebrities, government decisions, and reactions of activists towards certain phenomena relating to bitcoin influence prices significantly.